TALLY TDL CUSTOMISATION FOR CHARITY IN INDIA

A Walkthrough video / Demo of the TDL is available at https://www.youtube.com/watch?v=7WnfcbRgQ3k

Introduction

Streamline Financial & Statutory Compliance for NGOs such as Section 8 Companies, Charitable Trusts, and Societies. Customisation (TDL) in Tally Prime Accounting ERP for preparing Donation Receipts and generating Donation Details in Form 10BD for uploading on the efiling website of the Income Tax Department.

Highlights

Ease Statutory Compliance for Income Tax & FCRA, Donor Engagement and Reporting, Audit efficiency.

Trusted Solution

Proven and live in 15 plus States & UT of India.

Ease of Tax Compliances for Charitable Trusts, Society, Section 8 Companies that is various NGOs registered u/s 12A and u/s 80G of the Income Tax Act, 1961.

System Requirements:

TallyPrime, MS-Excel 64 Bit – For Excel TallyPrime ODBC

Terms

Our Add-on is attractively priced at Rs 10,000/- per TallyPrime serial (Silver) & Rs 15,000 per TallyPrime serial (Gold).

Lifetime License. Includes updates, if any, for the period of 1 year from date of License.

Contact us at innovation@canirmalg.com com with TallyPrime Serial No for Trial tcp (TDL) File.

THIS ADDON ENABLES THE USER TO:

- 📋 Donor Management: Capture and maintain complete donor information, including ID & contact details, with the ability to quickly import data from Excel.

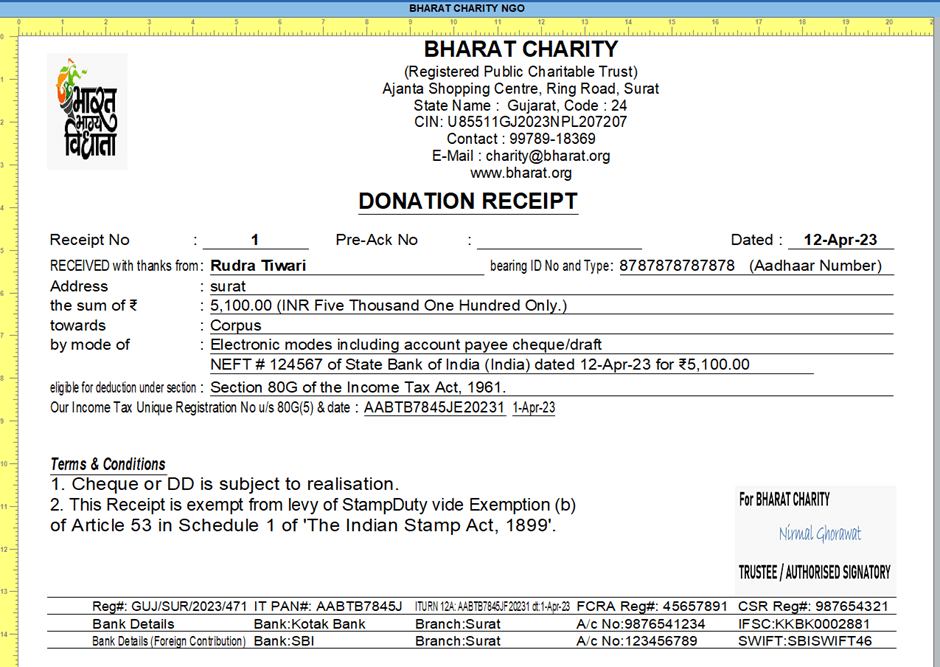

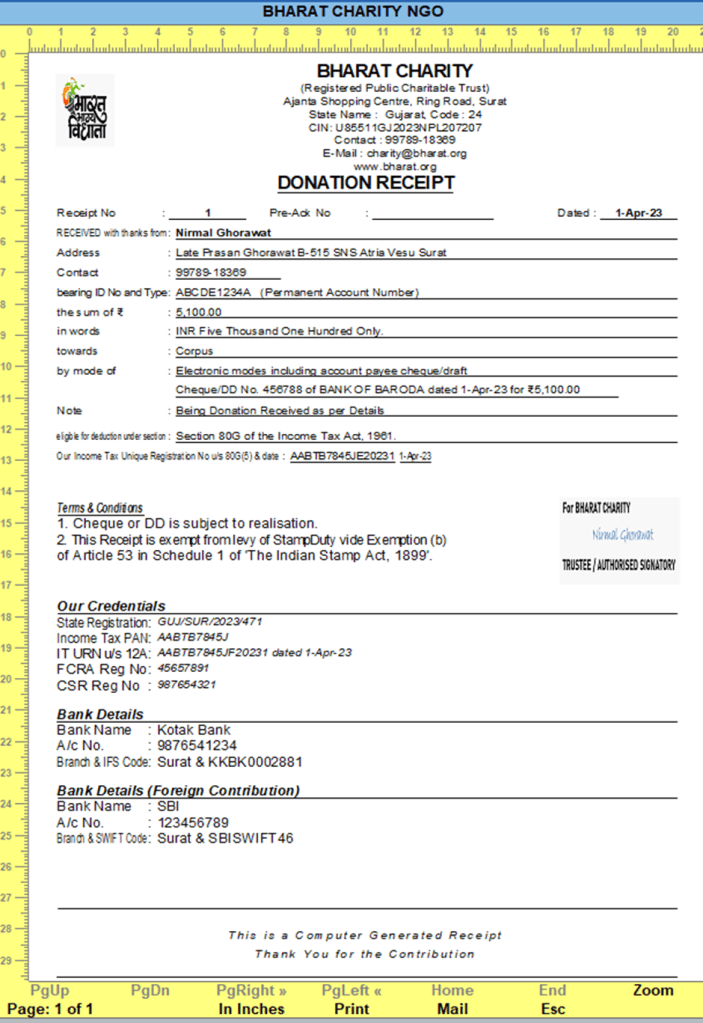

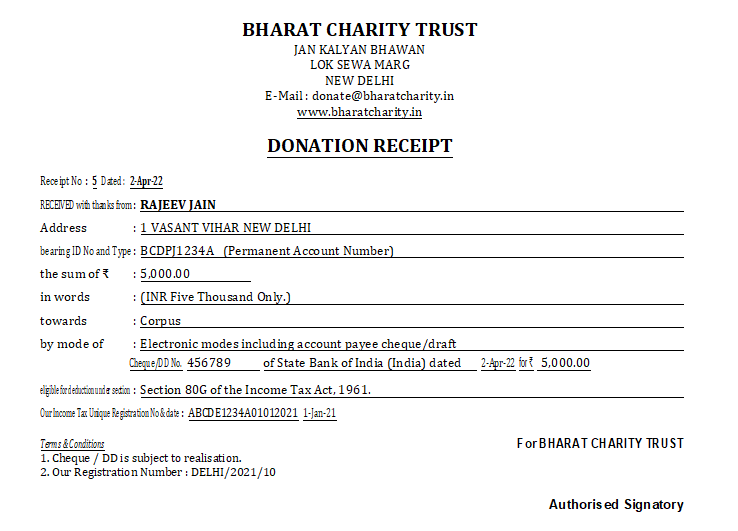

- 🧾 Donation Receipts: Prepare / Print detailed donation receipts in A5 or A4 size, complete with your organization’s seal and signature, all within Tally Prime.

- 📩 eMail Donation Receipts: to the Donor email id from Tally Prime with Summary Details in eMail Subject & Message body & Donation Receipt as PDF attachment.

- 📊 Form 10BD Reporting: Simplify compliance with Income Tax rules by generating accurate Form 10BD for donor and donation reporting in Excel CSV format.

- 📚 Donation Register: Keep a well-organized donation receipts register for easy access and transparency.

- 📑 Accounting with ITR 7 Classification: Add ITR-7 classifications to ledgers to enable reporting of voluntary contributions, aggregation and application of income, and reconciliation of reported amounts in ITR-7 with accounting records.

- 📑 Audit-Ready Reporting: Prepare basic details and legal, donation summary and donor wise donation data tables seamlessly for Income Tax Audit Reports in Form 10B/10BB, making audit preparation timely and stress-free.

- 🌍 Foreign Contributions: Reporting of basic details, foreign donations and list of bank accounts in FC-4 Annual Return.

USER MANUAL

SAMPLE DONATION RECEIPT AS GENERATED (A5 & A4)