The Fourth Schedule of Income Tax Act, 1961 deals with Recognised Provident Fund.

Rule 8 in the Fourth Schedule provides, subject to fullfillment of the following conditions, for Exclusion of Accumulated Balance in Provident Fund from Total Income i.e., to say, exempt the contribution and accretions to Provident Fund from the purview of Income Tax Act, 1961 —

(i) if he has rendered continuous service with his employer for a period of five years or more, or

(ii) if, though he has not rendered such continuous service, the service has been terminated by reason of the employee’s ill-health, or by the contraction or discontinuance of the employer’s business or other cause beyond the control of the employee, or

(iii) if, on the cessation of his employment, the employee obtains employment with any other employer, to the extent the accumulated balance due and becoming payable to him is transferred to his individual account in any recognised provident fund maintained by such other employer; or

(iv) if the entire balance standing to the credit of the employee is transferred to his account under a pension scheme referred to in section 80CCD and notified by the Central Government.

Explanation.—Where the accumulated balance due and becoming payable to an employee participating in a recognised provident fund maintained by his employer includes any amount transferred from his individual account in any other recognised provident fund or funds maintained by his former employer or employers, then, in computing the period of continuous service for the purposes of clause (i) or clause (ii) the period or periods for which such employee rendered continuous service under his former employer or employers aforesaid shall be included.

Rule 9 in the Fourth Schedule of the Income Tax Act, 1961 provides for method of conputing Tax on Accumulated Balance read with Section 111 of the Income Tax Act, 1961.

Where the accumulated balance due to an employee participating in a recognised provident fund is included in his total income owing to the provisions of rule 8 not being applicable, the Assessing Officer shall calculate the total of the various sums of tax which would have been payable by the employee in respect of his total income for each of the years concerned if the fund had not been a recognised provident fund, and the amount by which such total exceeds the total of all sums paid by or on behalf of such employee by way of tax for such years shall be payable by the employee in addition to any other tax for which he may be liable for the previous year in which the accumulated balance due to him becomes payable.

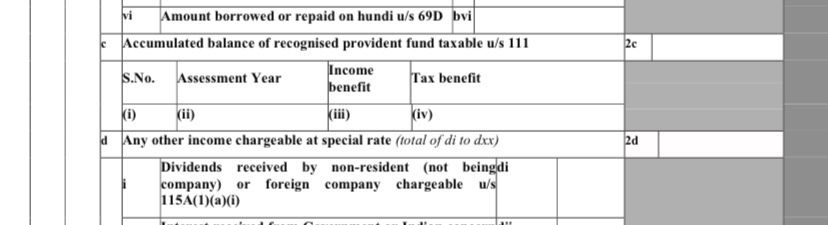

Clause (c)(iii) in Schedule OS of ITR 2 – The particulars of Income arising from Accumulated Balance of Recognised Provident Fund is required to be declared in the following manner ::

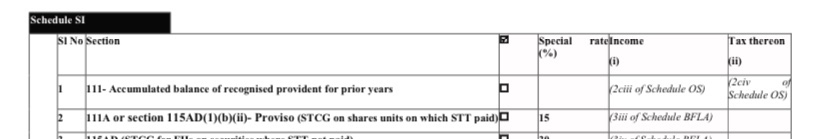

Schedule – SI Tax on Income subject to Special Rates of Taxation Serial No 1 – the Tax amount of Total in (c)(iv) is to be specified / filled.

Summary

If on account of non-rendering of “continous service” with an employer contributing to recognised provident fund, the Accumulated Balance therein becomes Taxable under Rule 9 read with Section 111:-

The Assessee would be required to Recompute for all previous Assessment Years :-

- Recompute Income from Salary by including Employer’s Contribution to PF

- Recompute Section 80C deduction availed by excluding Employee’s Contribution to PF

- The sum of above would be Income Benefit for purpose of Clause (c)(iii)

- Recompute Tax (but not Surcharge or Cess) at applicable rates after adding the above Income Benefit for relevant Assessment Year for purpose of Clause (c)(iv)