Section 87A of the Income Tax Act, 1961 deals with Rebate to Resident Individuals. Finance Act, 2023 introduced a Proviso to Section 87A (w.e.f 1-4-24 ie., AY 2024-25).

Rebate of income-tax in case of certain individuals.

87A. An assessee, being an individual resident in India, whose total income does not exceed five hundred thousand rupees, shall be entitled to a deduction, from the amount of income-tax (as computed before allowing the deductions under this Chapter) on his total income with which he is chargeable for any assessment year, of an amount equal to hundred per cent of such income-tax or an amount of twelve thousand and five hundred rupees, whichever is less.

[Provided that where the total income of the assessee is chargeable to tax under sub-section (1A) of section 115BAC, and the total income—

(a) does not exceed seven hundred thousand rupees, the assessee shall be entitled to a deduction from the amount of income-tax (as computed before allowing for the deductions under this Chapter) on his total income with which he is chargeable for any assessment year, of an amount equal to one hundred per cent of such income-tax or an amount of twenty-five thousand rupees, whichever is less;

(b) exceeds seven hundred thousand rupees and the income-tax payable on such total income exceeds the amount by which the total income is in excess of seven hundred thousand rupees, the assessee shall be entitled to a deduction from the amount of income-tax (as computed before allowing the deductions under this Chapter) on his total income, of an amount equal to the amount by which the income-tax payable on such total income is in excess of the amount by which the total income exceeds seven hundred thousand rupees.]1

Section 87A of The Income Tax Act, 1961

1. Proviso inserted in section 87A by the Finance Act, 2023, w.e.f. 1-4-2024

Section 115BAC deals with Tax Rates under the New Tax Regime.

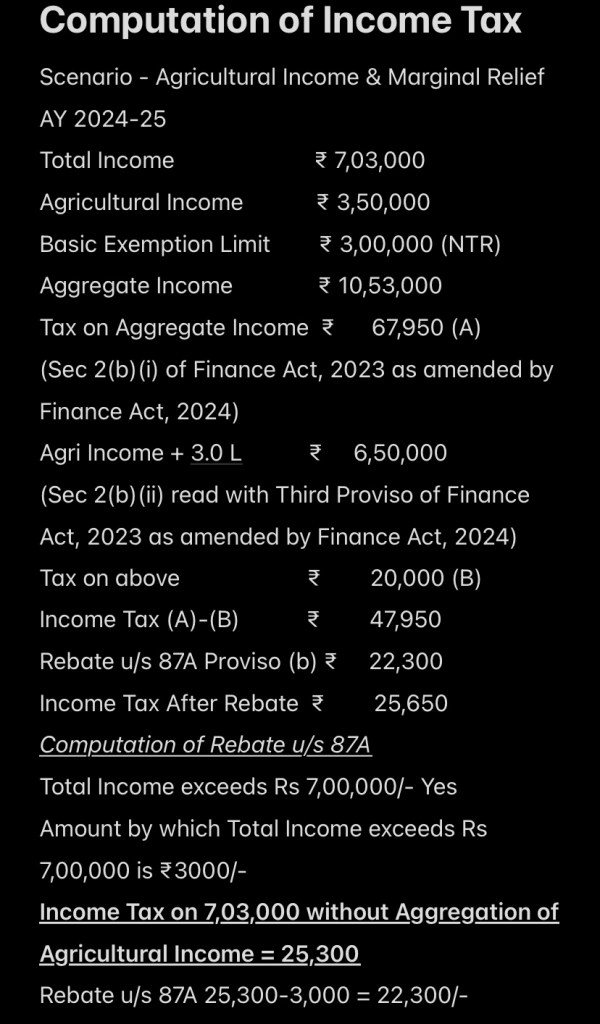

Case 1 : Total Income (without aggregation of Agricultural Income) exceeds Rs 7 Lakhs.

Clause (b) of Proviso to Section 87A will apply for Computation of Tax Rebate u/s 87A.

NB: While computing Income Tax Payable on such Total Income exclude Agricultural Income.

Computation of Income Tax in a Scenario where Marginal Relief & Agricultural Income for AY 2024-25

Case 2 : Total Income (without aggregation of Agricultural Income) does not exceed Rs 7 Lakhs.

Clause (a) of Proviso to Section 87A will apply for Computation of Tax Rebate u/s 87A.

NB: While computing Income Tax Payable on such Total Income exclude Agricultural Income.

Computation of Income Tax in a Scenario where NO Marginal Relief & Agricultural Income for AY 2024-25