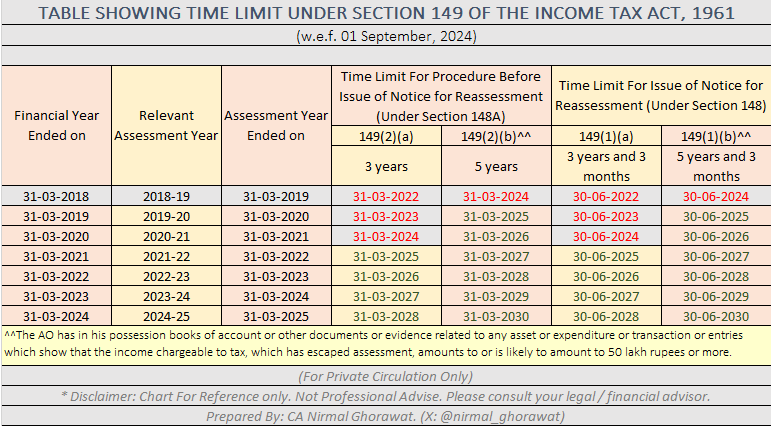

The Income Tax Act, 1961 has been amended by Finance (No. 2) Act, 2024 w.e.f. 01 September, 2024. Procedure including Time Limits for Reassessment has gain undergone a major change.

It may be noted that there is no change in sub-rule (5) of Rule 6F of Income Tax Rules, 1962 – which mandates the period for which books of accounts and other documents are required to be maintained.

The books of account and other documents specified in sub-rule (2) and sub-rule (3) shall be kept and maintained for a period of six years from the end of the relevant assessment year:

Provided that where the assessment in relation to any assessment year has been reopened under section 147 of the Act within the period specified in section 149 of the Act, all the books of account and other documents which were kept and maintained at the time of reopening of the assessment shall continue to be so kept and maintained till the assessment so reopened has been completed.