Scenario

M/s A. B. & Co is a Partnership Firm.

Query

- Whether the Partnership Deed must specify the individual partners designated as Working Partners?

- Whether the Partnership Deed can merely state that the remuneration payable to the working partners shall be as per the provisions of the Income Tax Act?

- Finance Act, 2024 has amended the limits to remuneration to partners in Section 40(b)(v) of the Income Tax Act, 1961. Whether the partnership deed needs to be amended to authorise for higher remuneration and the effective date of such authorisation in partnership deed.

- Suggest draft clause in the Partnership Deed relevant to Management (Working Partners) & Remuneration to Working Partners.

Response

Section 40(b)(v) of the Income Tax Act, 1961 deals with the (dis)-allowance of Remuneration to Working Partners of the Firm.

Amounts not deductible.

40. Notwithstanding anything to the contrary in sections 30 to 38, the following amounts shall not be deducted in computing the income chargeable under the head “Profits and gains of business or profession”,—

…..

(b) in the case of any firm assessable as such,—

(i) any payment of salary, bonus, commission or remuneration, by whatever name called (hereinafter referred to as “remuneration”) to any partner who is not a working partner; or

(ii) any payment of remuneration to any partner who is a working partner, or of interest to any partner, which, in either case, is not authorised by, or is not in accordance with, the terms of the partnership deed; or

(iii) any payment of remuneration to any partner who is a working partner, or of interest to any partner, which, in either case, is authorised by, and is in accordance with, the terms of the partnership deed, but which relates to any period (falling prior to the date of such partnership deed) for which such payment was not authorised by, or is not in accordance with, any earlier partnership deed, so, however, that the period of authorisation for such payment by any earlier partnership deed does not cover any period prior to the date of such earlier partnership deed; or

(v) any payment of remuneration to any partner who is a working partner, which is authorised by, and is in accordance with, the terms of the partnership deed and relates to any period falling after the date of such partnership deed in so far as the amount of such payment to all the partners during the previous year exceeds the aggregate amount computed as hereunder :

(a) on the first Rs. 3,00,000 of the book-profit or in case of a loss Rs. 1,50,000 or at the rate of 90 per cent of the book-profit, whichever is more;

(b) on the balance of the book-profitat the rate of 60 per cent :

Explanation 1.—Where an individual is a partner in a firm on behalf, or for the benefit, of any other person (such partner and the other person being hereinafter referred to as “partner in a representative capacity” and “person so represented”, respectively),—

(i) interest paid by the firm to such individual otherwise than as partner in a representative capacity, shall not be taken into account for the purposes of this clause;

(ii) interest paid by the firm to such individual as partner in a representative capacity and interest paid by the firm to the person so represented shall be taken into account for the purposes of this clause.

Explanation 2.—Where an individual is a partner in a firm otherwise than as partner in a representative capacity, interest paid by the firm to such individual shall not be taken into account for the purposes of this clause, if such interest is received by him on behalf, or for the benefit, of any other person.

Explanation 3.—For the purposes of this clause, “book-profit” means the net profit, as shown in the profit and loss account for the relevant previous year, computed in the manner laid down in Chapter IV-D as increased by the aggregate amount of the remuneration paid or payable to all the partners of the firm if such amount has been deducted while computing the net profit.

Explanation 4.—For the purposes of this clause, “working partner” means an individual who is actively engaged in conducting the affairs of the business or profession of the firm of which he is a partner;

On a plain reading of the above, one can deduce that the following conditions have been imposed for allowance of Partner’s Remuneration under the Income Tax Act, 1961.

- Remuneration can only be paid to a “working partner”. (Sub-clause (i))

- Remuneration must be authorised by & paid in accordance with the terms of partnership deed. (Sub-clause (ii))

- Remuneration cannot be authorised by partnership deed for a period prior to the date of such partnership deed. (Sub-clause (iii))

- The total amount of remuneration paid to Partners shall not exceed the specified limits (sub-clause (v)).

- Partner in representative capacity (say a Director of Company, where the Company is a Partner), any remuneration paid to such Director by the Partnership Firm is not counted as [Partner’s Remuneration] (Explanation 1)

- Similarly, if the Karta is Partner in the Firm & the HuF (not being partner) is paid Interest on Deposits / Unsecured Loans, the same shall not be counted as [Interest Paid to Partner]. (Explanation 2)

- Book Profits for the purpose of computing limits of Partners Remuneration shall be computed as per Chapter IV-D of Income Tax Act, 1961 and include any Partners Remuneration. (Explanation 3)

- Working Partners means an individual who is actively engaged in conducting the affairs of the business or profession of the firm of which he is a partner.

The CBDT has considered the allowability of Remuneration to Partners in Circular No 739 dated 25.03.1996 particularly, the referring to

two types of clauses which are generally incorporated in the partnership deeds. These are :

(i) The partners have agreed that the remuneration to a working partner will be the amount of remuneration allowable under the provisions of section 40(b)( v) of the Income-tax Act; and

(ii) The amount of remuneration to working partner will be as may be mutually agreed upon between partners at the end of the year.

………………………

3. In cases where neither the amount has been quantified nor even the limit of total remuneration has been specified but the same has been left to be determined by the partners at the end of the accounting period, in such cases payment of remuneration to partners cannot be allowed as deduction in the computation of the firms income.

4.It is clarified that for the assessment years subsequent to the assessment year 1996-97, no deduction under section 40(b)(v) will be admissible unless the partnership deed either specifies the amount of remuneration payable to each individual working partner or lays down the manner of quantifying such remuneration.

On a combined reading of the Section 40(b) and CBDT Circular 739 supra, we can summarise ::

The partnership deed must be unambiguously state :

- The names of partner individuals who are appointed as “working partners” of the Firm.

- The role and responsibility of the “working partners” including active engagement in conducting the affairs of the business or profession of the firm.

- The amount of remuneration payable to each individual working partner or lay down the manner of quantifying auch remuneration.

- The limit of total remuneration may be specified (such as any amount exceeding the maximum permissible limits under the Income Tax Act, 1961).

- In case of amended Partnership Deed, the amendments with respect to remuneration / interest will apply from the date of the partnership deed (and cannot be given retrospective effect).

Sample Clauses in Partnership Deed.

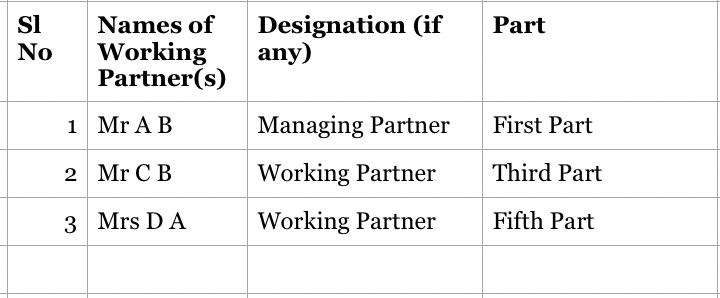

- Management

The Partnership (/LLP) business shall be carried on by the following partners as Working (/Designated) partners faithfully, diligently, honestly, lawfully and in the best interests of the firm (/LLP) and in accordance with the policy and decisions taken by the Partners from time to time.

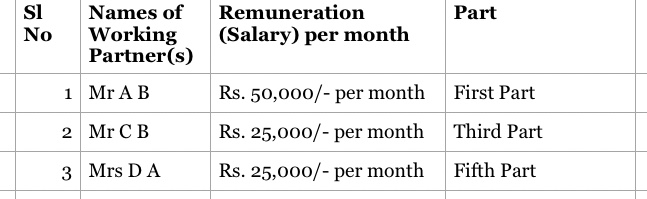

2. Remuneration to Working Partners

In consideration of the Working Partners actively engaging in conducting the affairs of the Partnership (/LLP) Firm, the Working Partners shall be paid a Salary per month subject to the time devoted by them towards the affairs of the firm per month as specified below::

Provided that the total remuneration payable to all the Working Partners as above shall be subject to the limits specified under sub-clause (v) of Clause (b) of Section 40 of the Income Tax Act, 1961.

Further Provided that in case of shortfall of “book profit” available for payment of salary / remuneration the working partners, the same shall be payable to the working partners in the ratio of the remuneration had there been no such shortfall.

One response to “Income Tax Query 8: Remuneration Clause in Partnership / LLP Deed.”

💕