Sub-section (7) of Section 139A prohibits a person who has already been allotted a permanent account number under the new series to apply, obtain or possess another permanent account number.

If you have been Inadvertantly allotted more than One PAN by the Income Tax Department, you can Surrender the Additional PAN by submitting Form 49A ~ Changes / Correction in PAN Card.

In Serial No 11 – of the Form 49A Correction – Mention the PAN inadvertantly allotted to you to SURRENDER the same.

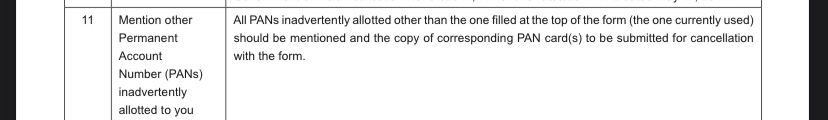

Instructions to Sl No 11 of the Form 49A Correction, require you to

1. Mentional all PANs inadvertantly allotted to you (other than the one filled at the Top of the Form (the one currently used) ) and

2. the copy of the corresponding pan cards to be submitted for cancellation with the form.

The Assessing Officer is empowered under section 272B of the Income Tax Act, 1961 to impose a penalty of ₹10,000/- for Failure to comply with the provisions of Section 139A.

However, Order imposing Penalty shall be passed only after giving an opportunity of hearing to the person on whom the penalty is proposed to be imposed.

Leave a comment